WATERLOO, Ontario, Canada, July 20, 2023 (ENS) – Six public pension funds in the United States would be $21 billion richer if they had divested from fossil fuels a decade ago, new research from a Canadian university calculates.

The study, from the School of Environment, Enterprise and Development at the University of Waterloo in partnership with the nonprofit Stand.earth, analyzed the public equity portfolios of six major U.S. public pension funds, which collectively represent 3.4 million people, to determine the effect divesting from their energy holdings 10 years ago would have had.

The researchers used Bloomberg Terminal data to examine the portfolio performances of six funds between December 31, 2012 and December 31, 2022. They then analyzed how the funds would have done if the fossil fuel investments had not been included over the same time period.

The report, “The Impact of Energy Investments on the Financial Value and the Emissions of Pension Funds,” was presented at the Institute for Energy Economics & Financial Analysis, IEEFA, Energy Finance Conference on June 22.

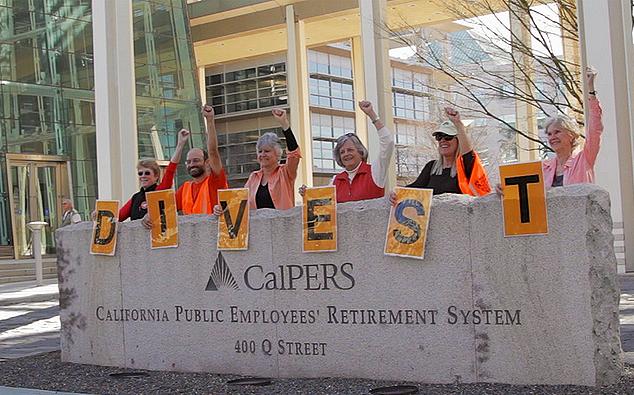

Their report presents the results of analyses conducted on a group of pension funds that face popular demands to decarbonize their investment holdings, the Climate Safe Pensions Network.

The analyses demonstrate that the cumulative value of the public company equity portfolio of pension funds would have been 13 percentage points higher on average if the funds had been divested from the fossil fuel energy sector 10 years ago.

Another analysis of the same U.S. public pension funds included in the Waterloo report found that had they divested 10 years ago their carbon footprint would have been reduced by an amount equivalent to the emissions generated by powering 35 million homes per year with fossil fuels.

Data for eight funds were available, including:

- Alaska Permanent Fund Corporation (APFC)

- Alaska Retirement Management Board (ARMB)

- California Public Employees’ Retirement System (CalPERS)

- California State Teachers’ Retirement System (CalSTRS)

- Colorado Public Employees’ Retirement Association (CoPERA)

- New York State Teachers’ Retirement System (NYSTRS)

- Oregon Public Employees’ Retirement Fund (OPERF)

- State of Wisconsin Investment Board (SWIB)

Their report demonstrates that divesting creates additional financial value, lowers exposure to climate risks, and reduces the carbon footprint of portfolios, the Waterloo researchers concluded.

“Influential investors, like these large public pension funds, can bring about positive change on a few fronts,” said Dr. Olaf Weber, professor in the School of Environment, Enterprise and Development at Waterloo and lead author of the report.

“Energy divestments can create higher returns for the funds, which leads to higher returns for the beneficiaries and reduced exposure to climate risks. Consequently, it leads to safer pensions,” Weber said.

Thousands of organizations are divesting – selling off their holdings in fossil fuel companies – according to Gofossilfree.org, a nonprofit organization that maintains a searchable database of them, managed by Stand.earth. With offices in the United States and Canada, Stand.earth works “to create a world where respect for people and the environment comes first.”

Gofossilfree.org says it is, “A global movement to end the age of fossil fuels and build a world of community-led renewable energy for all.”

Their database shows that to date 1,552 institutions have divested. The total value of the institutions divesting is estimated to be $40.5 trillion.

Many of the divesting organizations are large and inclusive – faith-based organizations such as the World Council of Churches, and professional organizations such as the World Medical Association. Hundreds of colleges and universities have divested, such as the University of California, University of Cape Town, University College London, and, of course, the University of Waterloo.

Divestment Climate Suffered Through Pandemic, War

The Waterloo report also explored ways that recent changes in the performance of the energy sector due to major global events – such as COVID-19 and Russia’s war in Ukraine – would have influenced the pension funds.

During the last three years, the value of the fossil fuel sector has gone up because of the pandemic and reduced oil supply from Russia. So, divestment has not been attractive from a financial point of view.

During this period, the world’s top financial institutions stopped putting their money behind Alberta oil sands production, one of the dirtiest oil reserves.

In December 2020, insurance firm The Hartford stopped insuring or investing in Alberta oil production, weeks after the Riksbank, Sweden’s central bank, said it would no longer hold Alberta’s bonds. BlackRock, the world’s largest asset manager, said one of its fast-growing green funds would stop investing in any firm that gets revenue from the Alberta oil sands.

Banks, pension funds and global investment houses are pulling away from fossil-fuel investments amid growing pressure to show they are doing something to fight climate change.

“If you look at how destructive oil sands can be, there’s a very strong rationale,” Armando Senra, head of BlackRock’s iShares Americas funds, told reporters, saying that the oil sands, along with coal, are “the worst offenders … from a climate perspective.”

The Union of Concerned Scientists says fossil fuels – coal, oil, and natural gas – are too dangerous to burn, although in the United States, they supply roughly two-thirds of US electricity generation.

“But fossil fuels come with a cost. Coal smoke is linked with everything from asthma and birth defects to cancer and premature death. Natural gas fracking is tied to contaminated groundwater and earthquakes. And oil is the single largest source of air pollution and smog in the world,” the Union of Concerned Scientists says.

“Fossil fuels are also the main source of global warming emissions, one of the most pressing existential issues facing humanity today. Understanding the scope of their impacts is critical for informing our choices around energy production—and for preventing the worst impacts of climate change,” the scientists’ organization advises.

The results of the Waterloo analyses demonstrate that the cumulative value of the pension funds’ equity portfolios would have been higher if they had divested from the energy sector 10 years ago. The report found that even in times of high performance in the fossil fuel sector, divestment does not reduce financial returns for the divesting entity.

“If climate chaos like fires and floods weren’t enough, this latest report strengthens the case even further that public pension funds must divest from fossil fuels as part of meeting their fiduciary duties,” said Amy Gray, senior climate finance strategist at Stand.earth.

“As the longest-term investors for workers, the last thing pension funds should be doing is gambling with retirement and deferred wages of their members,” she said.

Three years ago, the Vatican called on Catholics and the private sector to divest their fossil fuel holdings. Pope Francis said in the Vatican publication “Laudato Si.”

“Building safe, accessible, reliable and efficient energy systems based on renewable energy sources would make it possible to respond to the needs of the poorest populations and at the same time limit global warming,” the Pope said.

Nearly 100 congregations and dioceses have divested, including whole countries such as the Catholic Church in Greece and the Scottish Catholic Bishops’ Conference, according to the GoFossilFree.org database.

And today the urge to divest is even stronger among climate activists, especially those for whom the issue is personal.

“This new Waterloo data hits home for me,” Miguel Alatorre Jr. with Fossil Free California said. “My mom is a beneficiary of a public pension, and my family is depending on that retirement income for security. It’s unconscionable to me that these funds are investing in fossil fuel companies driving climate change, heat waves, wildfires and flooding, all while losing income for workers.”

For the six funds analyzed using data from the Bloomberg database, the total value of the ex-energy portfolios would have been US$424.6 billion, while the total value of the reference portfolios was $402.8 billion.

The difference is more than $20 billion.

Featured image: Singapore, July 8, 2020. Capable of refining 592,000 barrels a day, the Singapore Refinery is ExxonMobil’s largest in the world. ExxonMobil Asia Pacific Pte. Ltd. is one of the largest foreign investors in Singapore with more than S$25 billion in assets. (Photo by budak)

© 2023, Environment News Service. All rights reserved. Content may be quoted only with proper attribution and a direct link to the original article. Full reproduction is prohibited.