WASHINGTON, DC, January 14, 2015 (ENS) – The first equity index-linked World Bank Green Bond available to retail investors just closed, and it was a big hit, raising more than US$91 million to support environmental solutions, the bank has announced.

The World Bank Green Growth Bond was the first Green Bond linked to an equity index designed for retail investors in Belgium and Luxembourg. It turned out to be the largest public offer subscription for a non-Euro equity index-linked bond in those two countries last year.

A total of 10 banks distributed the product, together representing a large proportion of the Belgian market. The subscription period for the bond, a EUR 50 million note with a 10-year maturity, lasted a total of six weeks, from November 17 to December 29, 2014 with a one day reopening on January 7, 2015 to satisfy investor demand.

“This offering marks the first time equity index-linked World Bank Green Bonds are accessible to retail investors and we are thrilled that the bonds met with such success,” said Doris Herrera-Pol, director and head of Global Capital Markets at the World Bank.

“The transaction highlights the World Bank’s ongoing appeal to investors across the board, offering an opportunity to support environmental solutions while maintaining a long-term performance potential,” said Herrera-Pol.

World Bank green bonds support the financing of projects in member countries that meet specific criteria for low carbon and climate resilient growth, seeking to mitigate climate change or help affected people adapt to it.

There was strong appetite from investors for the World Bank Green Growth Bond, with the minimum issuance target of US$15 million reached in the first three days of launch. The transaction closed with a total subscription amount of just over US$91 million.

The product was developed in partnership with BNP Paribas Corporate and Institutional Banking.

Renaud Meary, global head of structured equity, BNP Paribas Corporate and Institutional Banking, said, “The appeal of this product in Belgium and Luxembourg points to continued trends in the responsible investing space. BNP Paribas is committed to driving progress in sustainable and responsible investment solutions, and was proud to partner with the World Bank to deliver this pioneering solution to retail investors.”

The World Bank says its Green Growth Bond is designed to deliver three key objectives for the environmentally conscious investor: “eco-citizenship, peace of mind, and return on capital.”

At maturity, investors are entitled to the repayment in U.S. dollars of 100 percent of their original capital investment by the World Bank.

And at maturity, investors can potentially earn a redemption premium that is linked to an ethical equity index, made up of 30 European companies selected according to sustainability criteria defined by independent organizations.

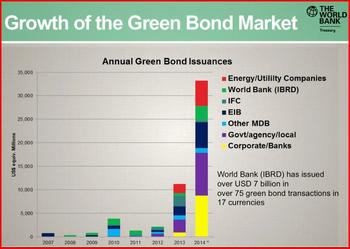

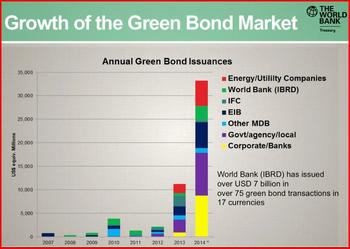

Since its first green bond launched in 2008, the World Bank has raised over US$7 billion through about 75 green bonds in 17 different currencies all over the world.

All World Bank green bonds offer investors an opportunity to support environmental solutions through a bond product that benefits from the triple-A credit strength of the World Bank.

World Bank green bonds support the financing of projects in member countries that meet specific criteria for low carbon and climate resilient growth, seeking to mitigate climate change or help affected people adapt to it.

The types of eligible projects include renewable energy installations, energy efficiency projects, and new technologies in waste management and agriculture that reduce greenhouse gas emissions and help finance the transition to a low carbon economy.

They also include financing for forest and watershed management and infrastructure to prevent climate-related flood damage and build climate resilience.

The World Bank’s Green Growth Bond is linked to the Ethical Europe Equity Index, which consists of 30 European stocks, selected based on an analysis by Vigeo, an independent and well-established Environmental, Social and Governance rating agency, and Forum Ethibel, an independent Belgian consulting agency that rates and audits sustainability, ethics, and social responsibility metrics of corporations.

The Ethical Europe Equity Index is owned, calculated and managed by Solactive, a global index provider.

Copyright Environment News Service (ENS) 2015. All rights reserved.

© 2015, Environment News Service. All rights reserved. Content may be quoted only with proper attribution and a direct link to the original article. Full reproduction is prohibited.